Crash Lending to Crash Landing – Macro Views

Ugly macro, banking crisis spreading to other parts, smart money looking for safe heavens in Gold & BTC, memecoin mania

THE BIG PICTURE – Systematic Banking Crisis

We are in the middle of a systemic banking crisis. For the first time I feel, and believe, that things are getting out of control for the US government. More than 50% banks are under water and the only option seems is consolidation. Bigger shark eat the smaller shark, backed by whale guarantees. In simple terms, this is beginning of nationalisation of the US banking system.

The crypto complex, is full of maximalists, who think that the entire global system will collapse along with the US. BTC and Gold will emerge as the only safe heaven. That is giving some steam to BTC but its still missing the institutional flows to take it beyond $35K.

Questions for this month:

- Could the small regional bank pain spread to other banks or other parts of the bank like CRE, CMBS etc?

- Given that FED hinted a pause, how long before FED pivots? Why should it pivot?

- Other consequences of a prolonged rate increase

- What does it all mean for crypto?

MACRO – Bearish, and Getting Uglier

“Those who cannot remember the past are condemned to repeat it”

Spanish philosopher George Santayana is credited with the above aphorism

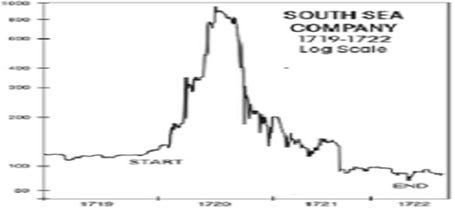

Recently I came across a very fascinating piece of history written by The Macro Ops on a 300 years old debt Monetisation scheme run by the UK government under the disguise of South Sea Company (SSC). As the UK government was full to the brim with debt, they created a unique debt program where a newly created trading company SSC would buy their debt and the public would buy SSC stocks. In return SSC got military contracts and subsidised lands.

The South Sea company – a front for UK government debt monetisation, that had never made a profit from trading, was worth 300 million pounds at its height. That is about 300 years ago. It was owed over 60 million pounds by the people it had lent money to, to buy its stock, which was more than all the money in Britain. To put this all into perspective, on a value to national economy basis, in the modern US, the South Sea company would be worth roughly $90 trillion dollars. That is correct. What caught my attention was the fact that governments have been manipulating public into buying their debt under one disguise or another for over 300 years. Hand in glove with large corporate run by “friends and family”, its always the retail that is left holding the bag. If we haven’t learned anything 300 years, why do you think anything different now?

The crux of the matter is that governments have always taken too much debt. Every time they are in a soup, they find a new way to get out with a fancy acronym for a new scheme. This time is NOT going to be different. They will continue to monetise their debt by disguising the public with a much fancier, newer scheme. It is my duty to present it to you as clear as water, and it is your duty to protect you hard earned money. No one else is going to do that for you.

What most people don’t understand about money is that it was never meant to benefit the people at expense of the gov. It was meant to benefit the gov. Would be nice if was other way around. But it’s not. So get over it & use this knowledge to your advantage. Or you are ngmi.

— Santiago Capital (@SantiagoAuFund) May 6, 2023

That said, in the modern world, where information moves at the speed of light, we are all much aware now and a large section of the society is fed up and can catch governments new ploys easily. The problem however is that:

- Governments cannot control spending. In fact every year spending, debt and interest on that debt continues to go up

- Tax receipts are not increasing domestically and internationally. It is no longer easy to conquer new lands in Asia and Africa like 200 years ago and plunder their wealth

The banking & mortgage crisis in 2008, EU & greek default in 2012, pandemic led mayhem in 2020, UK gilts mini crisis in 2022 & now regional banks in 2023. These are nothing new, just mini crisis if a larger debt looming crisis. While the name and nature of these crisis continue to change, their basic premises remains same – excessive debt. Same cycle has been repeatedly been abused for the last 500 years:

- Take on public debt and fund your wars

- Boost domestic consumption with this debt and imported plunders of the world

- Increased consumption increases demand, aka inflation

- Pay some debt back, keep other rolling and keep issuing new debt – till you cant any more

- Push the can down the road till inflation becomes a household issue (UK, US, Egypt, Sri Lanka, Pakistan, Venezuela etc etc)

- Come up with a new fancy “Program” and let public buy back your debt by hyper inflating your currency

- Take more debt – and cycle continues

- Only the high & mighty nations can do that for a 100-150 years. And then everyone realises the Ponzi. No one give more debt and system collapses

Are the leaders of the Democratic and Republican parties concentrating on protecting their respective Lords, or investors’ capital?

As a steward of your capital, you must ask yourself — “do I want to continue to hold assets in a regime with these political and financial issues? Or would I rather ride it out in the (relative) safety of gold and or crypto?”

Arthur Hayes, “I Will not be exit liquidity!”

What Happens From Here?

- The FED increased its federal funds rate to a range of 5% to 5.25%, the highest level in 16 years – but signalled a potential pause in the future. A pause (or even an expectation of a pause) is good for risk assets

2. The banking stress is not over – First Republic Bank stock price plummeted 70% earlier during the week and then another 50% on last Friday of April. An overall drop of around 99% this year.

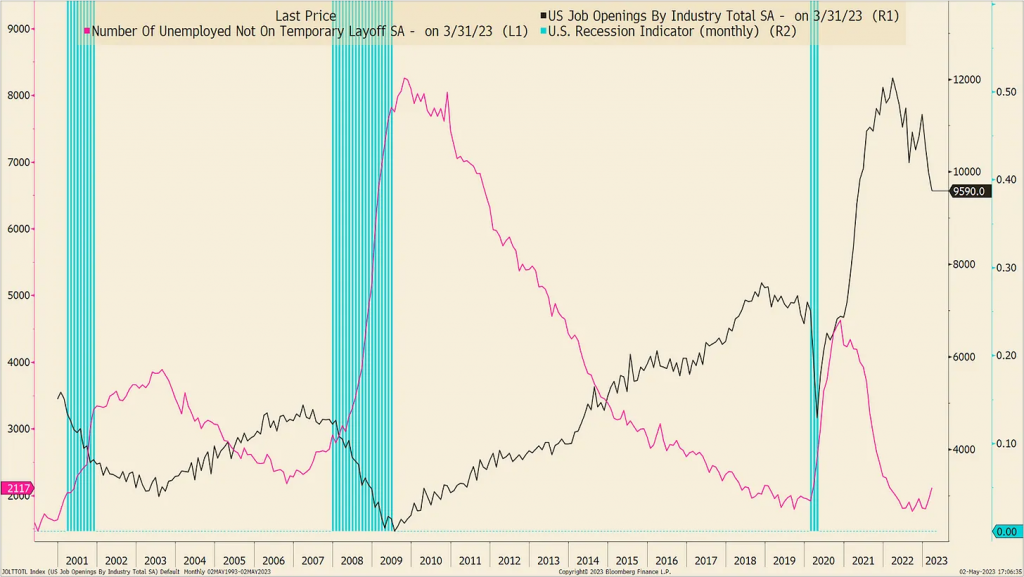

3. Money supply conditions stay tight putting further pressure on regional banks as depositors flee for safety and higher rates .

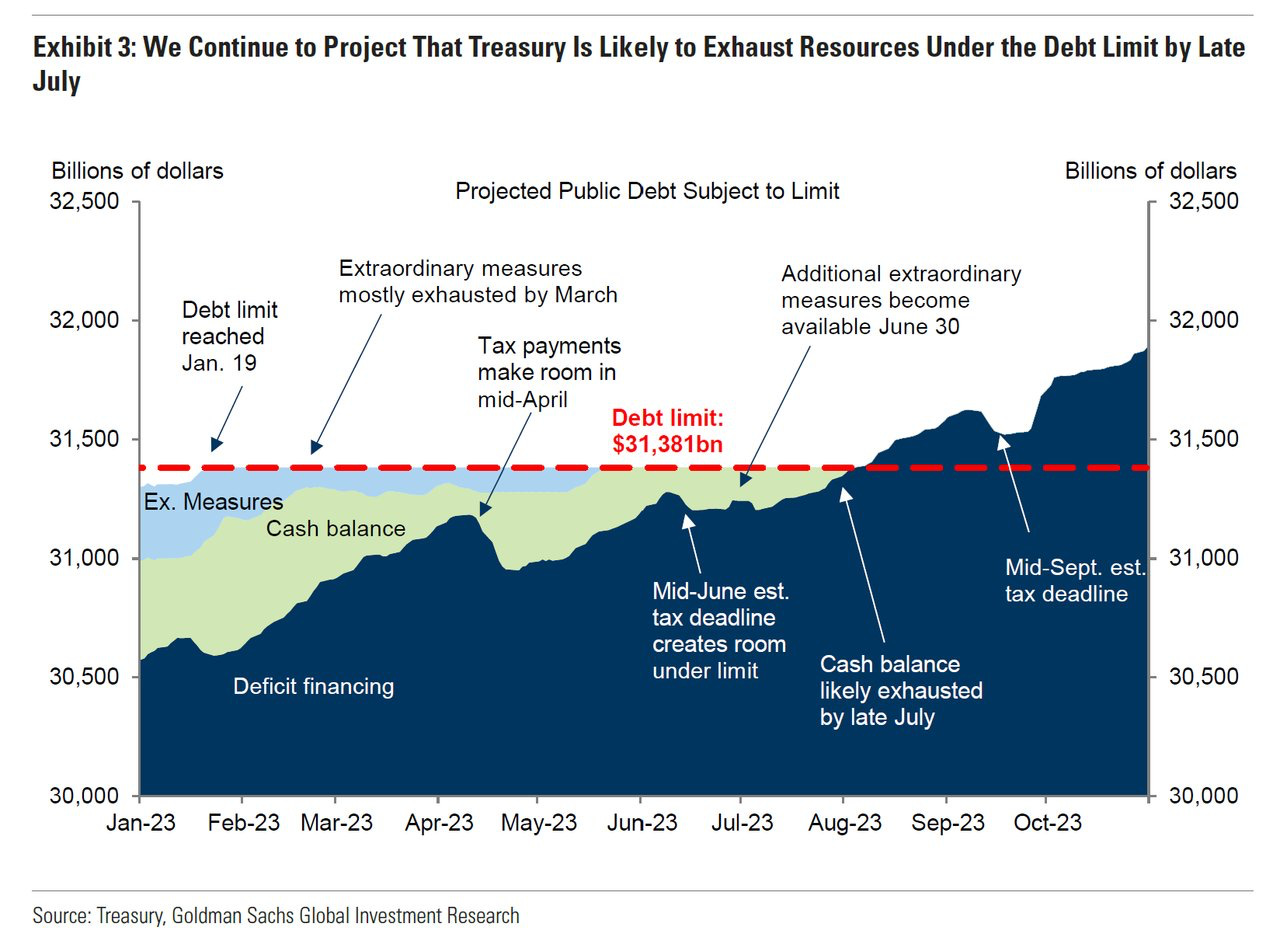

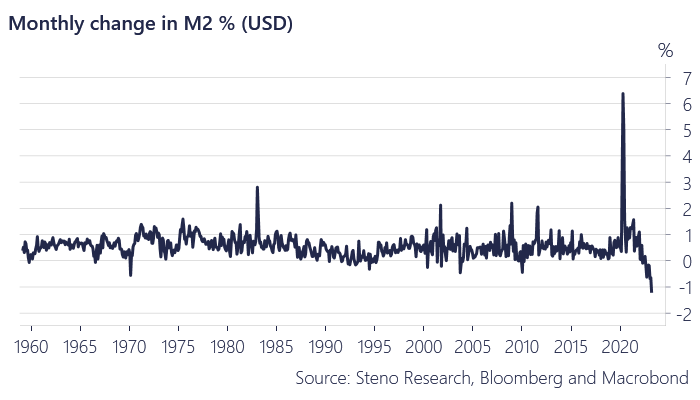

4. US debt is ballooning. Almost $32 trillion now. And that is not even taking Into account the off balance sheet liabilities like social security and medical. Its not just the US – EU, UK and China are in no better position when it comes to debt. But they all have room to push the can just like the South Sea Company and UK government. And that is QE – directly or indirectly.

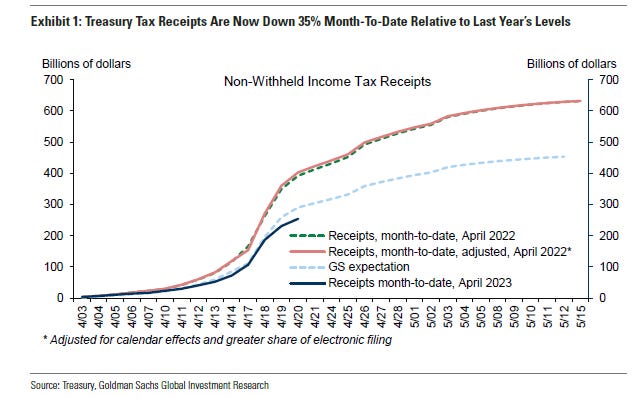

5. High debt means high interest payments, especially if rates are higher. That interest is also going bonkers. At about $800bn per annum, we might hit a trillion dollars in wasted debt interest payments soon. The question however is – what does the government do when debt becomes too high. Increase your income i.e. tax receipts. That looks unlikely. Look at the chart below not even close to 2022 receipts, so far

6. Dollar is declining and CDS on govt debt is climbing – Dollar is not going anywhere but the trade in dollar and the trust is dollar is certainly declining.

7. Inflation – The question then is when is that point of rate cuts? The rhetoric for FED, has moved from “control inflation at any cost” to “worried about banking crisis”. That’s a massive shift. Expected. But massive. On the surface, inflation is still not in control as housing and wages are a big part of that CPI number. I believe that will start to drop like flies as borrowers are unable to meet payments and buyers put purchases on hold. Inflation should come off massively by Q3 and give room for FED to pivot by Q4, along with other factors like job losses, wage pressure, falling commodity prices, recession, etc etc.

For the FED to cut rates, one of the there things need to happen:

- Inflation, wages and PMI numbers show signs of continue weakness in a recessionary environment – very much possible by Q4

- Something truly breaks on a massive scale. I am not talking a monthly bank breakdown here but a series of banks or other stresses in the system like CRE, CMBS, bonds etc

- Some interantional crisis – geopoltiical or monetary

Up until then we are looking at 5-5.5% kind of federal rates.

Consequences of Higher Rates for Longer

This unfolding of banking crisis is a rehearsal of uglier things to come in my opinion unless FED pivots and cuts rates. Few things are clear as water:

- No one in their sane minds is going to keep their hard earned (or I’ll gotten) money in regional / small banks

- Money market funds will keep on enjoying those deposits moving to them as they can offer almost par to federal 5% rates

- Credit starts to become tight as as banks deposits wane. Small to medium businesses that rely on local banks – suffer and start cutting demand, employees, wages and some go belly up. We are looking at around q3/4 for such a scenario

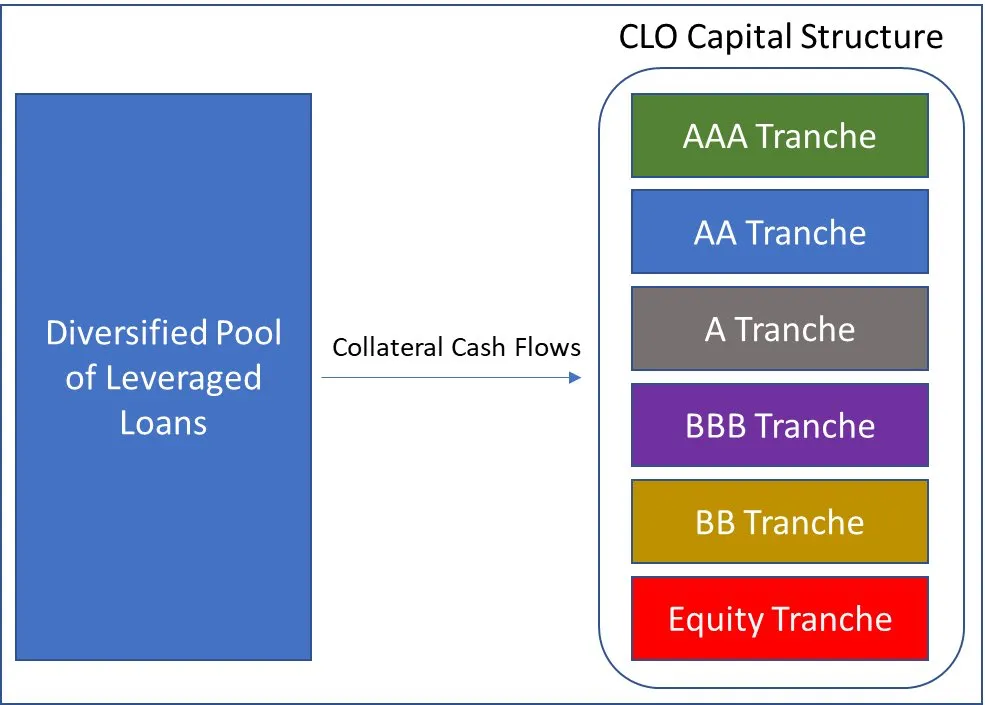

- Problems start emerging in other areas of banks lending portfolio – CRE, CMBS, leveraged loans and their CLO buyers, corporate debt etc. Large banks start to suffer and economy starts to really contract as we stare a full blown recession – q3/q

5. Recession is a non-nothing probability at this time which means lesser demand & lesser inflation

That is exactly what FED wants, before they can announce some much needed rate cuts. Even better if something breaks and they become the go to plumber of choice – just like 2008, Covid crisis or SVB crisis. No one will blame them in such a situation and their political overlords come out as the saviors – and that too in an election year. Everyone is happy. Printer is back and we have few months of ecstasy filled markets in 2024.

But that is a 30,000 feet picture. It’s not going to straight up. Nothing moves in a straight line. But you get an idea of a secular direction here. Rate cuts are coming, probably by end of this year or even earlier.

How do you position yourself for such secular direction, of course if you believe that’s how it will play out:

- You stay in cash till something breaks and you go all in with a 20/30% correction. The risk is that might never happen

- You DCA in now onwards with every dip. That is dollar cost averaging. And you short some percentage using futures and options, if you believe there could be some massive squeeze (hedge)

- You go long only when you see first indications of FED cutting rates. Risk is that it just happens overnight someday and you miss the first 10-20% rally. Not bad. But a risk that you lose some or a lot of alpha.

CRYPTO MACRO – BTC preparing for next big cycle

EXECUTIVE SUMMARY

Bitcoin has been consolidating with uncertain macro conditions and finding it tough to break $30,000 resistance. But with some small push coupled with good news, we could quickly move to $35,000. There is a lot of liquidity up until those levels. Beyond that, I find it very difficult. FED June hikes are anticipated (in light of strong wages). So we might consolidate more around $33-35K levels next couple of months. Any pullbacks towards $24.5K and $20K would be short lived and good buying opportunities

LIQUIDITY MATTERS – BTC halving is currently expected around May 2024. Based on previous halving cycles, we seem to be an early accumulation phase. We have been consistently clear in our past monthly reports in January, February and March, as well as our annual report aptly titled LIQUIDITY MATTERS that all it matters for the next leg up before halving is LIQUIDITY. However, we have also had a very good run so far with almost 75% gains off the lows within the last 5 months. Either way, long term price bullishness in BTC is a given because at some point FED is going to unleash liquidity like the coldest water hose on a hot day.

BTC CONSOLIDATING BUT PREPARING FOR A RIDE OF A LIFETIME

- Pullback could be expected as volumes are sliding and institutions are missing currently. Also “Sell in May” is in play. Macro bearishness is not helping either and keeping institutions at bay for now

- Inflation is cooling, so is FED with a “pause”- leading to rate cuts

- But wages are looking stronger than ever – so FED keeping markets directionless till at least July in my opinion

- Two things are certain though – huge liquidity incoming at some point this year and secular bullish trend in BTC and crypto is intact

WHERE IS THE TRIGGER TO GO ALL IN you ask – I believe that trigger will be continued banking crisis, unlimited backstops by FDIC/FED/Treasury and contagion spreading to other parts of financial markets. So the first signs you see that something else is breaking, have your cash ready to plunge. Not financial advise, do your own research and read disclaimer.

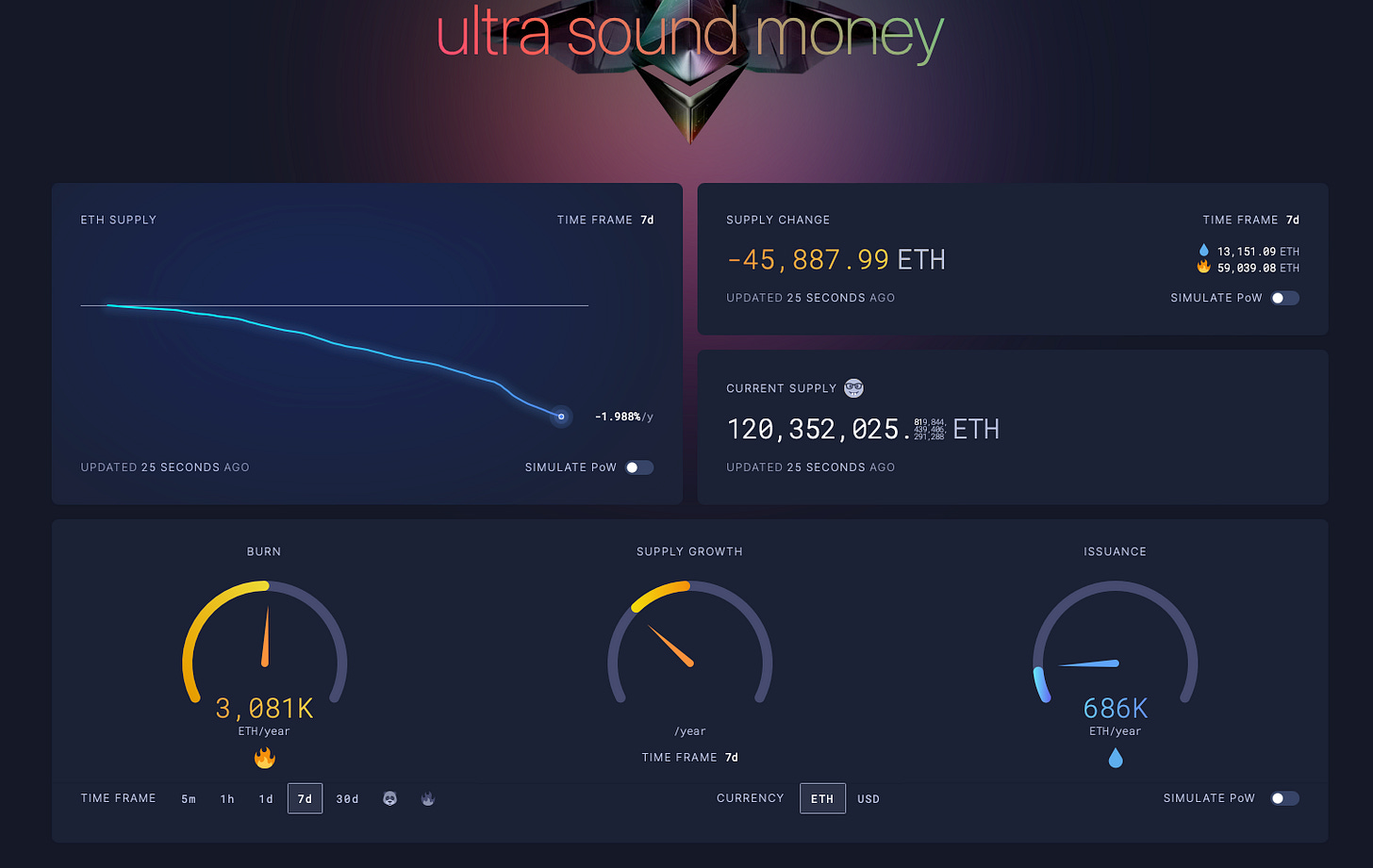

ETH – More bullish than BTC

The Shanghai upgrade was a game changer for ETH staking, making ETH into a global decentralised bond. Very few realise the consequences of that as TradFi bond market is the largest of all. If that institutional money starts to flow too ETH and ETH staking and convert into interest rate swaps, that is game over for USD. Game on for crypto & ETH. Not to mention the ETH supply that is burning with every transaction making it deflationary.

ALTS – What’s next as $PEPE hits $1B market cap?

$PEPE was listed on major exchanges and within 24 hours, reached a $1 billion market cap. That is just three weeks after its launch. I think too late to FOMO in now. But there are others that are popping up, in particular, POGAI (Poor Guy) on Arbitrum has done very well along with $KING and $POOR on Solana. But I think the time to FOMO is closed now. Please use your money wisely and DO NOT BE SOMEONE ELSE’s LIQUIDITY

Some other narratives that I am watching in Alts

- AI narrative will bounce back again at some point. I will be accumulating some of the coins that I mentioned in earlier newsletters – CFX, RNDR, FET

- Alongwith ETH, LSD coins should make a come back. I am DCAing into LIDO, RPL, FXS

- I stay bullish futures DEX’s – GMX, DYDX, GNS as I earn more in staking and ETH

- Some bets on other new L1’s like APT & SUI as well as older ones like ARB & SOL

- Also getting bullish on CRV as $crvUSD stablecoin is launched

- Spark Protocol, $MKR’s new lending product built on Aave V3, is expected to launch soon. Keep an eye

- $GALA v2 tokenomics upgrade goes live on May 15th, with the airdrop of new tokens on a 1:1 ratio to current holders. if you are bullish gaming long term, this one is for keeps

Leave a Reply