Rising Crystal Ball: 2023 Macro & Crypto Outlook

Liquidity Matters

Executive Summary

2022 was a very painful year for investors, across most risky asset classes. Unfathomable scams, hacks and plain vanilla embezzlements across crypto, wrecked most shrewd investors. Coupled with tightening liquidity, markets continue to infuse more pain as we enter 2023.

Meanwhile, there has been an exponential rise in crypto infrastructure over the last few years. It is quite evident that this new monetary layer of internet & digital ownership, is here to stay. With growing number of individuals and institutions participating in building out innovative solutions, 2023 might be the best year to build.

In this report we have tried to analyse global macro trends and how they impact crypto over the next couple of years. In doing so, we have also tried to identify some micro narratives, sectoral opportunities and trying to locate new trends before anyone jumps into them.

The Past

Age of Excess Liquidity

The traditional institutions and governments that we have known for centuries are becoming less and less trustworthy, and the people who trust them are becoming more and more disillusioned.

Wealth inequality has reached an all-time high, and the convergence of several new innovative technologies led to the rise of a new kind of currency: one that knows no borders, needs no permissions, and anyone can create with full ownership like bitcoin and ethereum.

1. Convergence of Technologies

- The convergence of technologies is enabling seamless and integrated experiences for users, as different technologies become more interoperable

- AI technology, for example, is rapidly evolving at an unmatched pace. And it’s not just AI—there are a number of other technologies converging at this time. These technologies will eventually converge simultaneously to create a future that is unimaginable today by most

Source: ARK Big Ideas 2022 Report

2. Internet of Value

- Majority of the Internet is owned and operated by large centralised organisations with little value trickling down to the actual users and creators – the most important group of participants

- The web3 framework and ethos enables value to be shared equally across all the participants through common network values for the first time in history by truly owning digital assets and creating a NETWORK with common mission, common goals and above all, without centralised overlords

Source: a16Z State of Crypto Report 2022

3. Blockchains are the most important piece of that puzzle

The Present

Institutions & Insane Valuations, Infra Build Up, CeFi Shitshow

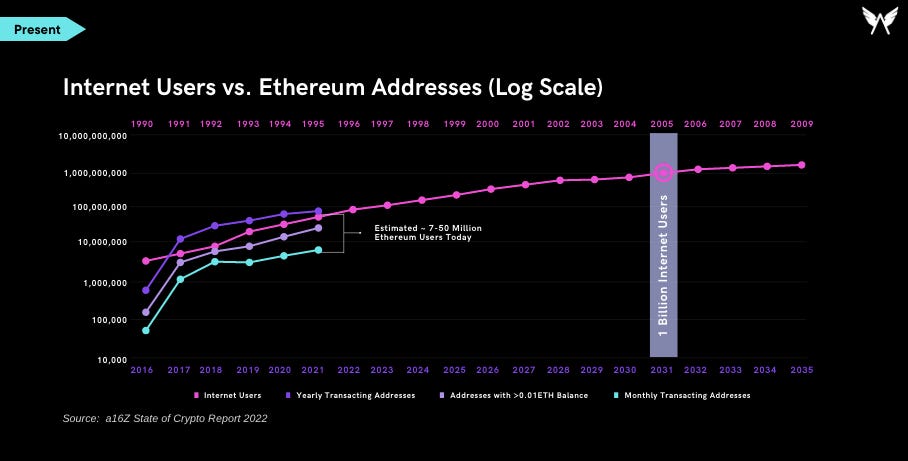

The crypto market experienced massive traction in the last few years, driven by both retail and institutional investors. This resulted in a huge infrastructure build-out and large funding inflows into the space.

Insane valuations eventually gave way to human greed. Scams, hacks and tighter liquidity conditions have hit the industry very hard. It will take some time to bring back the trust.

-

Massive Crypto Traction

-

218M Wallet Addresses on ETH Alone

-

30M+ Metamask Monthly Active Users

-

2.5M OpenSea Accounts

-

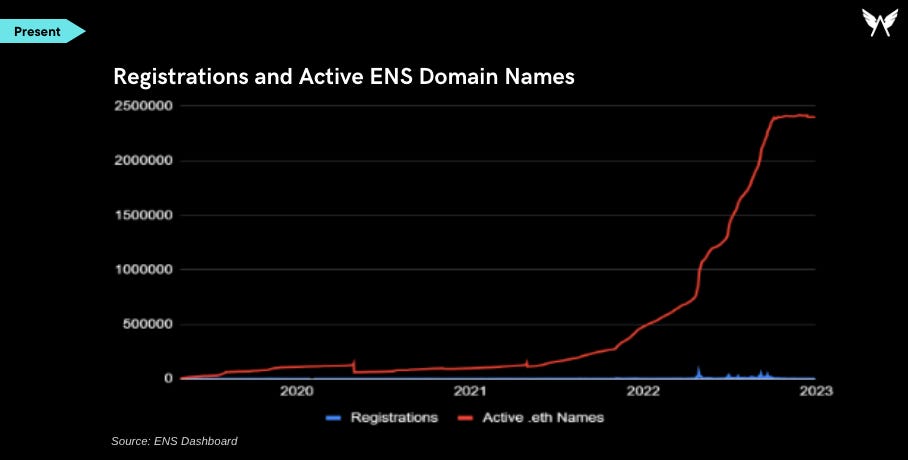

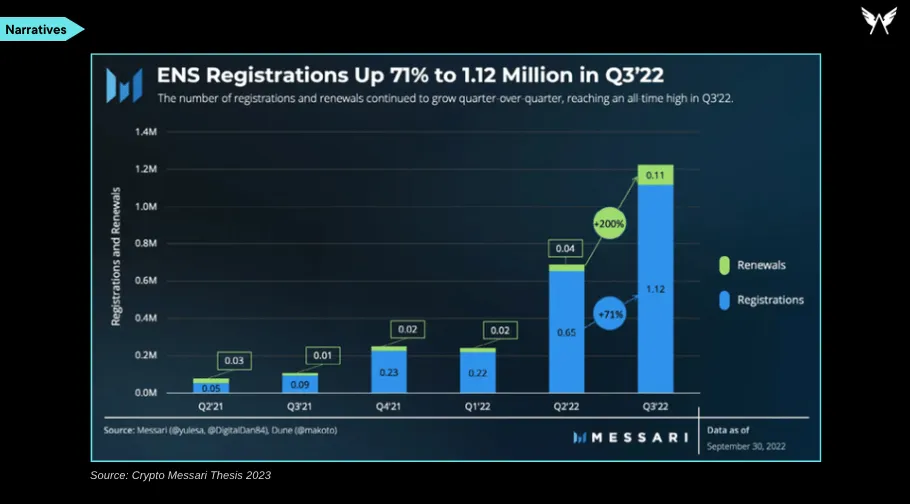

2.4M ENS Domains

-

Source: a16Z State of Crypto Report 2022

Source: ENS Dashboard

-

Driven by Institutions

-

As crypto rallied, smart money took notice

-

According to a new study by Fidelity, nearly six in ten institutional investors invested in digital assets globally in 2022. This represents an increase of over 20% from the previous year

-

-

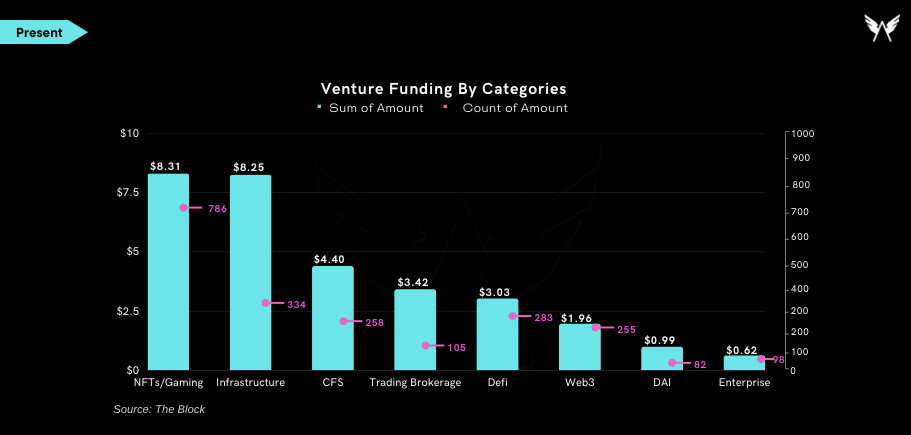

Massive Infra Built-Out

-

There has been huge growth in teams and talent that is building infrastructure on various blockchains. Over 1,700+ startups are building in the Blockchain Infrastructure sector (Tracxn)

-

Infrastructure sector experienced the second-largest funding inflow after NFTs and gaming in 2022. Alchemy and Fireblocks raise at $10 billion and $8 billion valuations at the peak

-

The entire crypto space experienced $30.95 billion across 2,201 funding rounds. Funding was at its peak in Q1-Q2 with highly inflated valuations

-

Source: The Block

-

Despite Setbacks, Crypto is Inevitable

Source: Crypto Messari Thesis 2023

-

And Builders are Building Like Never Before

Source: Crypto Messari Thesis 2023

The Future

Age of Austerity, Short Term Macro Pain, Long Term Crypto Gain

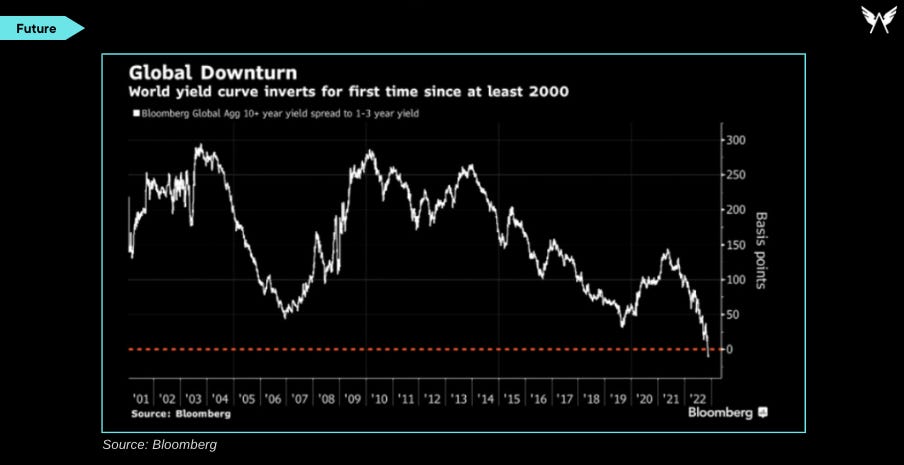

As inflation becomes sticky in a West vs East bipolar world, central banks will be forced to keep higher rates for longer till something breaks.

Governments should soon be back to borrowing to ease pain & dole out vouchers to electorate. That is a very uncertain world dangling between more printing, yield controls or high interest rates.

Gold, Digital Gold (Bitcoin), Bonds and other hard commodities should be largest beneficiaries in the long run.

-

Higher Rates For Longer?

-

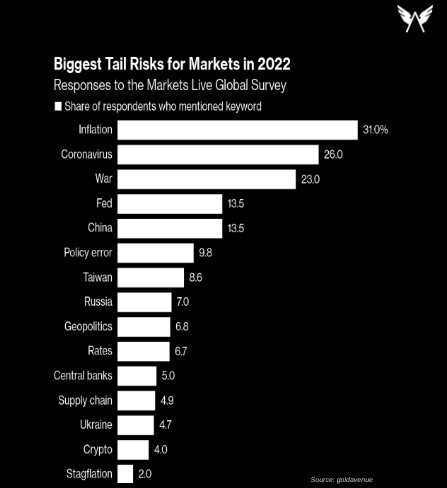

A FED pause is priced in for Q1’23 but any surprises on inflation can lead to capitualtion

-

Inflation could be sticky as West (USA++) fights East (China++) forcing CB’s to keep higher rates for longer due to supply chain issues, food shortages led by war (wheat, fertilizers etc) and rationing by countries (bauxite & nickel by Indonesia, chicken by Malaysia, wheat by India etc)

-

However, with recent layoffs, strong dollar, higher interest payment, inverted yield curve etc, the FED should be forced to pause. Market is waiting for that signal to push forward a relief rally

-

DCA into hard assets or blue chips for medium to longer term but there could be more pain in 1H’23 in case war escalates or inflation comes back roaring

-

Bitcoin as Digital Gold narrative will catch smart money attention again as macro improves, institutions comes back and BTC halving narrative picks up pace. As for ETH & Altcoins, we shall keep an eye on micro narratives like L2’s, infra, NFT’s & zK’s and some DCA into proven blue chips

-

-

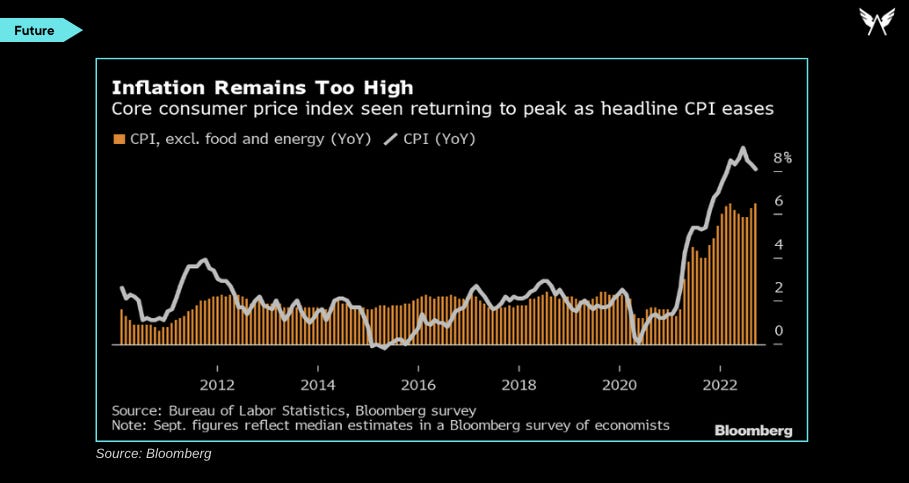

Sticky Inflation?

-

There is more room for FED to keep pushing rates higher till inflation is tamed and wages are down

-

3%-4% CPI might be the new norm vs 2% that FED expects

-

Continued conflict in Ukraine and Russia will keep commodities, especially grain, fertilizers, energy and metal prices relatively high

-

While FED might pause in Q1/Q2, rates could stay much higher for much longer into 2024 continuously squeezing out liquidity from the system

-

Long hard assets could be the best trade for many months and perhaps years to come. That includes assets like gold, hard commodities & bitcoin

-

Coming off of the low rates that followed the first Gulf War with Iraq, the Fed raised rates roughly 5% to 6% by the end of 1994. That resulted in the Mexican Peso crisis, and the US Treasury stepped in to bail out American lenders in Mexico. The Fed also pitched in by lowering rates a tad. A few years later, when rates rose to nearly 6%, the Asia financial crisis occurred. Various “Asian Tigers” came to the IMF and World Bank cap in hand asking for bailouts of their economies due to increased dollar funding costs.

Arthur Hayes, Annihilation, 2nd March, 2022

-

Dollar Dominance in Question

-

Higher rates means more demand for Dollars as bond yields go up. Smart money and resource importing nations will need to buy more dollars making it even stronger and hurting local currencies of importing nations

-

In the end, we are clearly moving to a two camp world between US & China. Dollars’ dominance is being threatened but for now there seems to be no solid alternative except Gold, and soon Bitcoin in our opinion

-

Emerging markets are hit hard like Sri Lanka and many others could follow as debt becomes due, especially as other developed nations are turning hawkish at the same time (BoJ, ECB, BoE) – Egypt, Turkey, Pakistan, Nigeria etc

-

Generally the world wants to be long dollar but the world is also starting to hedge that with hard commodities like Gold, and soon Bitcoin

-

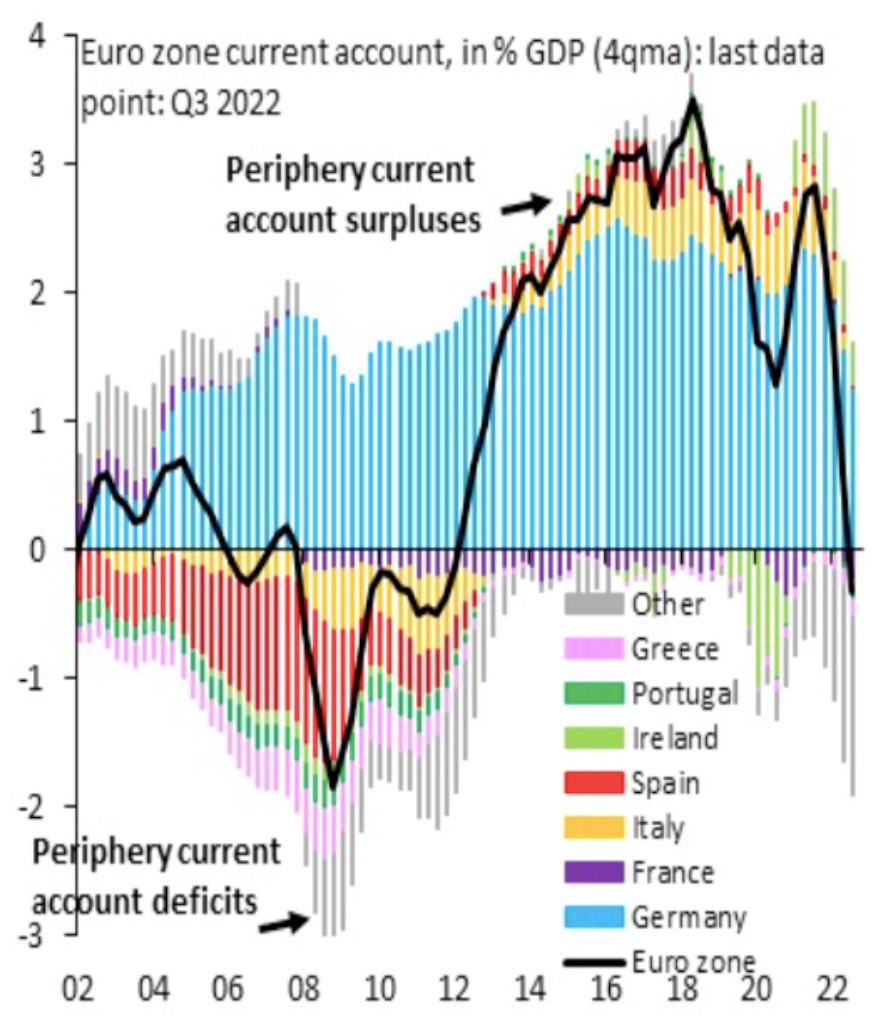

4. Eurozone In Crisis

-

Europe is generally in a very difficult situation as inflation is hovering around 10%, debt to GDP is escalating, war is hitting hard & manufacturing & exports are declining

-

ECB turned hawkish amid falling Euro and worsening debt to GDP, especially across PIGS nations. Italy seems to be at most risk vs others at 150%+

-

European banks carry a lot of this bad debt and could turn ugly as skeletons come out

-

Increasing escalations with Russia and an ongoing energy crisis continues to add pain

-

ECB hawkishness seems more like a temporary fix as issues are more structural in nature, exaggerated by war. We wish to remain short EURUSD as Eurozone hawkishness could outlast most countries

5. Geopolitical Risks

-

Supply chains are moving away from China to South East Asia & Mexico. This is permanently inflationary

-

Geopolitically, China is getting cosier with the Saudis – cheap Oil for cheap manufacturing

-

Taiwan remains an uncertain situation although we are not pricing any escalation in 2023

-

Oil, gas & essential food commodities could push inflation back to 8-10% in the US & Europe. Consequently CB’s could turn more hawkish leading to higher rates and higher dollar that hurts everyone

-

There are several more risk scenarios globally today but just one of the above is enough to throw the world into an abyss. Hence our ultra cautious stance for 2023 and focussing on hard assets and blue chips mostly

“President Xi’s visit with Saudi and GCC leaders marks the birth of the petroyuan and a leap in China’s growing encumbrance of OPEC+’s oil and gas reserves: with the China-GCC Summit, China can claim to have built a “special relationship” not only with the “+” sign in OPEC+ (Russia), but with Iran and all of OPEC+…

Here are the key parts from President Xi’s speech at the China-GCC Summit (all emphasis with orange underlines are mine): “In the next three to five years, China is ready to work with GCC countries in the following priority areas: first, setting up a new paradigm of all-dimensional energy cooperation, where China will continue to import large quantities of crude oil on a long-term basis from GCC countries, and purchase more LNG. We will strengthen our cooperation in the upstream sector, engineering services, as well as [downstream] storage, transportation, and refinery. The Shanghai Petroleum and Natural Gas Exchange platform will be fully utilized for RMB settlement in oil and gas trade, […] and we could start currency swap cooperation and advance the m-CBDC Bridge project”.

Zoltan Poszar, Credit Suisse, 27th December, 2022

Crypto Macro – The Year to BUIDL

2022 was a very painful year for every crypto investors. FTX saga and resulting dominoes should continue to unfold for few more months but majors and blue chips seem to be in a nice accumulation zone now.

2023 will be a slow grind as crypto follows global macro but finding early micro narratives (and more importantly exiting timely) will be the key this year.

Bitcoin halving & digital gold narratives should pick up pace in Q4 23’ along with better macro & resurgence of liquidity.

Smart money shall continue to rotate profits from micro narratives to ETH to BTC for foreseeable future till macro uncertainty goes away.

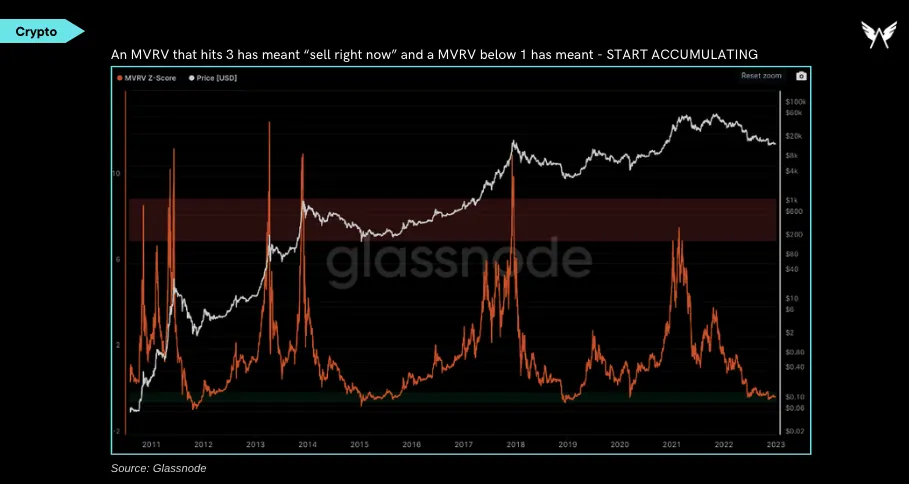

- Bitcoin: Accumulation Zone

- Most of the downside seems to be priced in for Bitcoin, even if we see more fallout from the FTX saga. A major support around $14.5-15K is forming and smart money is bidding

- Both on-chain indicators, as well as global macro scenarios explained above, point to a long term accumulation zone for BTC

- BTC “Digital Gold” & halving narrative should start to pick up in Q3’/Q4’23, coinciding with improving macro liquidity

- Bitcoin halving should push the hard asset narrative further as smart money knows that Bitcoin becomes even harder vs Gold at 1.6% inflation vs 0.8% in 2024. This could lead to a rally towards 25-30K by end of 2023

- The first step to Bitcoin & crypto reversal however, will be led by macro. LIQUIDITY taps must be either paused or turned back on again. For that to happen, inflation must be tamed. And that means short term pain for long term crypto gain

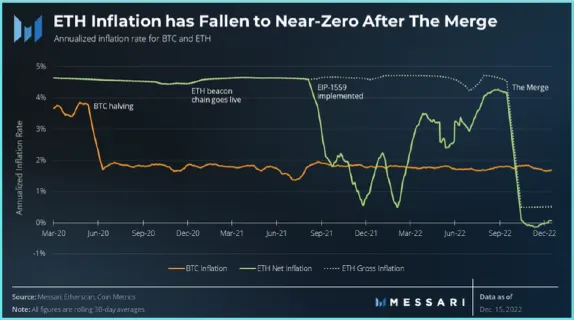

2. ETH – Main Settlement Layer

- ETH emerged even stronger in 2022 as a disinflationary asset with its Merge to Proof-of-Stake. Furthermore ETH “Shanghai’ upgrade and EIP 4844 sharding upgrades should happen in 2023 hopefully leading to a surge in ETH staking narrative like we are seeing on $LIDO

- We remain bullish ETHBTC for 2023 with ETH as settlement layer vs BTC that is largely a store of digital value. Plus we could see profits from micro narratives move to ETH first and then BTC

- Micro narratives in ETH & L1’s/L2’s should do well in 2023 provided one is able to get in early like we saw in Arbitrum, Art NFT’s, zK, AI in 2022. All this should be bullish for ETH in general

- DCA into ETH, blue chips L1’s that continue to hustle – Cosmos, Polygon, buy into micro narratives and revenue generating blue chips (UNI, MKR, GMX etc) is the key for 2023

- Staying away from SOL & FTX related chains for now till things clear up or SOL goes below a certain threshold

- Newer L1’s like Aptos, Sui, TON, LayerZero are yet to be battle tested with very limited applications

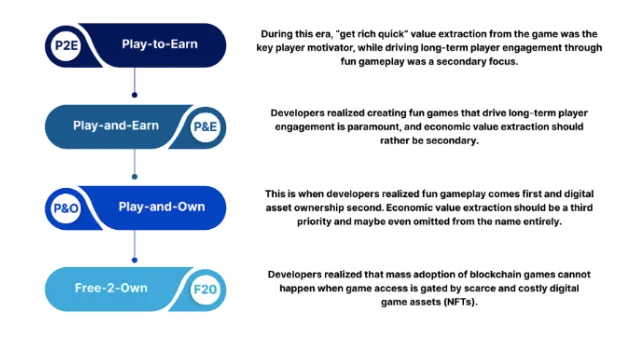

3. GameFi Winter

- It is going to get harder for GameFi founders to raise money without some basic user traction & KPI’s

- VC’s were already pulling back from GameFi in 2022, and that will become even tighter in 2023 since there are hardly any “FUN” games delivered yet

- 2H’23 and 2024 should see a lot of new web3 games come online. Very hard to say which ones will be successful

- Meanwhile, huge infrastructure is being built to make it easier for web2 studios and gamers to transition to web3. Web2 gaming studios are already learning & adopting blockchain tools & token incentives. This will further accelerate in 2023 and beyond

- We are very restrictive in investing in new games/studios unless the team and experience is exceptional and can show some traction – NFT holders playing the game, retention numbers, game session metrics, revenue pipeline etc

- There are some blue chip gamefi coins that are at bargain but 2023 seems to have limited upside for them as well

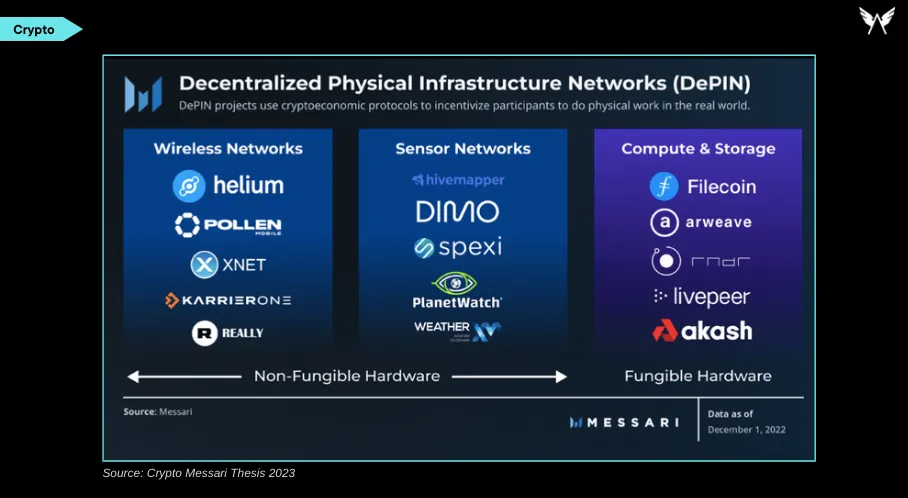

4. Dev Tools & Infrastructure

- Infrastructure projects could have major upside in 2023

- Decentralised Physical Infra Networks (DePIN’s) are the next logical step as the growth of web3 technologies and protocols propagates over the next decade. We are already experiencing a growing list of web2 and Web3 applications storing data on decentralised storage networks like Filecoin

5. Regulations and Stablecoins

- Regulators all over the world want to make sure their consumers are protected & no other disasters happen like 2022 – frauds, hacks scams, poor risk management, bad audits and plain vanilla frauds

- CeFi will face the major brunt and there could be new regulations for stablecoins, especially with the launch of its own CBDC’s SEC might becomes tougher on tokens and declare most are securities unless pre-approved – paving the way for talent to move elsewhere – especially Asia (Singapore, HK, Japan) and Middle East as the most favoured destination currently

6. DAOs Growing

- DAO’s combined Asset Under Management(AUM) has reached to $10 Billion in 2022 and members have been increased by threefolds. Over 3,000 proposals have been made and voted on the blockchain

- Regulations of DAOs and the process of forming legal DAO entities still remains blurry. We will need to see much more action on the framework and regulations end for DAO models to be adopted widely

Crypto Micro Narratives For 2023

There should be new micro opportunities across several crypto markets similar to what we saw in 2022.

NFT’s, Liquid Staking, Synthetic Assets, Real World Assets, DAO’s, L2’s, DePIN’s are some of the hottest themes where we will be on look out for.

Trick would be to get in early, not FOMO in late cycle and not get greedy. That is, to have an exit plan and not HODL forever because smart money will be ready to dump at first chance.

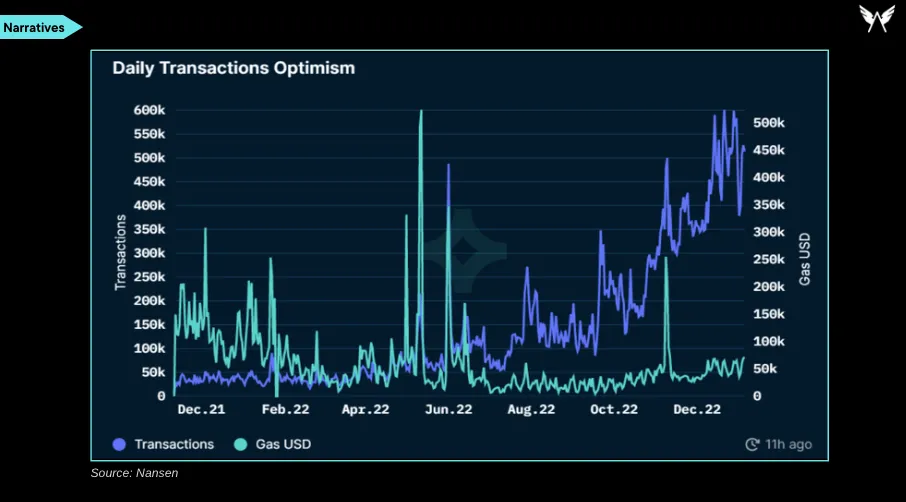

- L2’s & Roll Ups

- Arbitrum saw exponential growth thanks to DApps like GMX and when $ARBI token launches, it is likely to get another surge

- Optimism also had significant growth following OP launch and airdrops. Upcoming “Bedrock” plus “alternative proof systems” like zk-proofs and OP stack should lead to massive scalability

- We are bullish on Arbi coins for now especially on DeFi Options, DEX’s and the like – DApps like $GMX (derivatives), $MAGIC (gaming), $Dopex (Options), $PlutusDAO (Governance of other coins), $VSTA (stablecoin), $UMAMI (Yield Optimisation). They should also get you $Arbi airdrops

- Starkware is another one to watch here with coins like 10K Swap (DEX), Nostra Finance (Stablecoin), JediSwap (DEX) etc. They have deployed the token on Ethereum but hasn’t started trading yet so there could be some airdrops here

- We could see similar micro narratives on MOVE Chains (Aptos, Sui etc) later in the year as well

2. NFTs – Not Just Hype

- While crypto has been down, NFT’s are heating up and rebounding, especially projects backed by passionate communities and trusted leaders – just like Pudgy Penguins, Doodles, DeGods etc in 2022

- Whitelists and limited buyers that control most of the holdings could push prices higher, especially if there is hype, great team and a vibrant community. But remember to book profits regularly

- You could also get a chance to own some underpriced blue chips for the long hold like BAYC, MAYC, ENS Domains, Penguins, Yoots, Doodles, Azukis etc – similar to DeFi coins in 2020 – ones that are delivering, have revenue, large treasuries, massive partnerships and solid communities

- We remain very bullish on NFT’s in general and specific use cases like gaming, metaverse, corporate, traditional brands, identity tokens, token gated communities etc

- Rise of “phygital” as real world and metaverse co-exist where physical goods will have a digital receipts to be worn as avatars in the metaverse

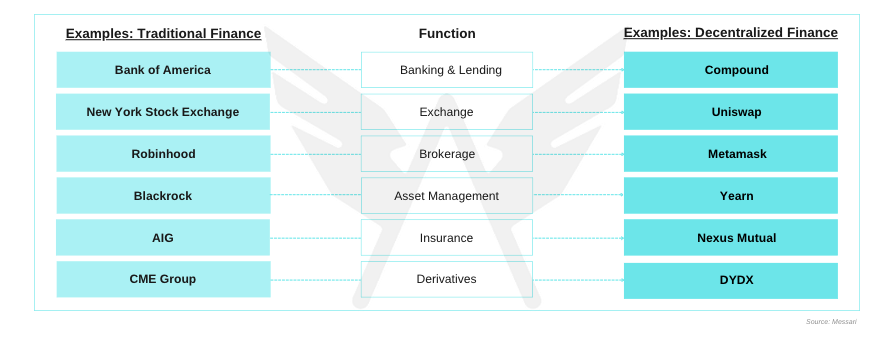

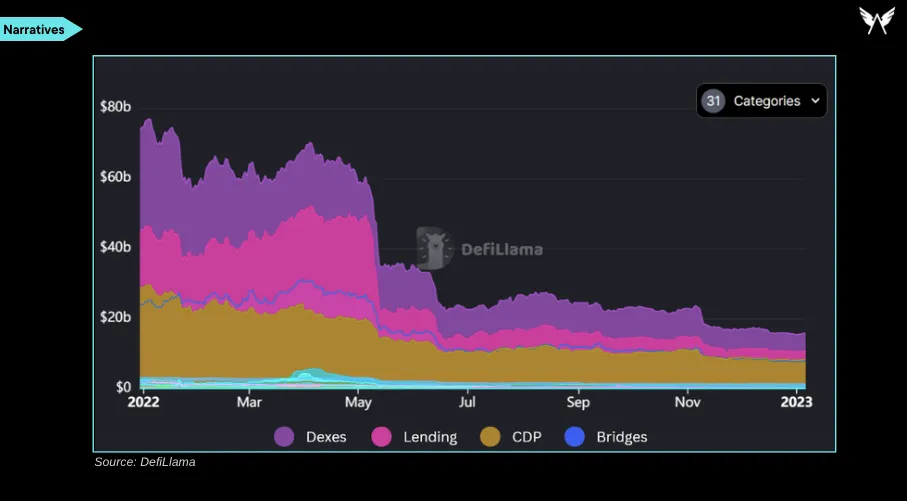

3. DeFI – 2.5 Incoming?

- Decentralised infra triumphed in 2022, while CeFi failed terribly

- 2023 should see another exponential build in DeFi Dapps with even more innovative solutions connecting TradFi

- Primarily in trading, derivatives, bonds, structured products, prediction markets, self-custody wallets, synthetic as well as RWA assets

- Many DeFi blue chips and new DeFi micro narratives on new blockchains could outperform ETH in 2023

- Best blue chip DeFi protocols were built in last bear market – AAVE, UNI, SUSHI, MKR, CRV etc. This time won’t be any different as infrastructure and multi chain capabilities have improved even further

- We like alternative L1s and mini narratives like Arbitrum, Optimism, Zk Rollups, newer protocols with focus on multi-chain / bridge plays & decentralized trading / derivatives

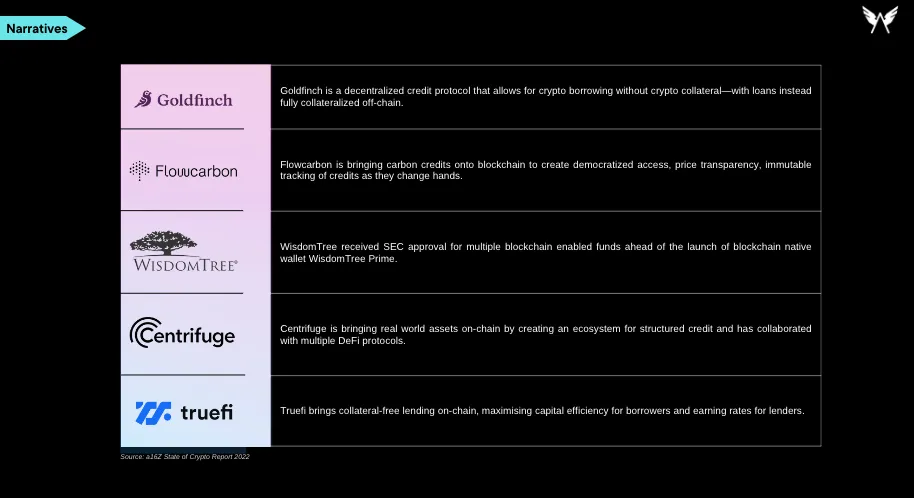

4. Real Worlds Assets

- Tokenization of real world assets could be other micro narrative that could push in 2023

- Trillions of dollars in assets sit off-chain, which can be turned into digital tokens on the blockchain, ushering in a new wave of DeFi primitives and applications

- Institutions should start to acquire RWA DApps as it removes the complexities from traditional settings and encourages transparency

- Major applications will be around larger TAM markets like loans, real estate, used products etc which have already grown considerably in 2022

- We expect multiple startups to pop up in this space coupled with regulated products and offering delivered on blockchain

Summarising the Opportunity

What worked in 2018/19 winter will most probably be true for 2023/24. What did we learn from our experiences back then, as we are headed into a deeper liquidity led crypto winter ? Before we answer those, some things are very clear:

- Inflation and Federal rates are the key to everything this year

- Liquidity will remain tighter, limiting any insane upside in risky assets

- Crypto is here to stay and builders are building like never before creating massive long term opportunities

With that backdrop, the question then is how do you identify those opportunities before anyone does? By asking the right questions.

- Is inflation going to be sticky and rates higher? Or something breaks and we are back to printing to appease voters? Our base case here is that inflation and rates will be higher for a while and 2023 will squeeze out more liquidity from the system

- How does Bitcoin perform in high rate, high inflation environment? Does low liquidity hurt Bitcoin investment? And the answer is Bitcoin will perform just like it was meant to – the Digital Gold. As we near the deflationary halving next year, both BTC and ETH should do well starting Q4’23/Q1’24

- What does it mean for Altcoins and where are the opportunities? While headline numbers might stay muted, we have a few micro narratives already brewing up for 2023 as discussed above. Like previous years, smart money will continue rotate the profits back to BTC & ETH regularly, and you should too

- What are those narratives and use cases that no one is discussing yet? Season 2.0 on DeFi, NFT’s, GameFi, Metaverse lands? Or new narratives on L2, AI, privacy, security, fun to play GameFi, metaverse, web3 social network etc?

- How do you identify such a product? How do you create that experience in one place? What blockchain do you build on or do you make it interoperable and multichain? How do you identify the players that are building that tooling and infrastructure for all that? And most importantly how do you bring millions of users to use those platforms?

In the end, no one has a crystal ball. We have been in crypto and macro for the longest time and that gives us an edge (at least we think so). The aim is not to be 100% right. No one can. Idea is to be right more than we are wrong and when we are right, we make sure we back those founders and ideas with conviction. .

2023 is going to be a very nervous year for investors, burdened with losses from last year and a myriad of things that can go wrong. While crypto is at its nadir, there is always more pain that can be inflicted. For example, no one anticipated 3AC, Luna, Celsius, FTX, SBF etc in their wildest dreams at the end of 2021.

At Rising Capital, we are constantly speaking to brilliant founders as well as other network participants, who are building some of the most interesting products both in blockchain and tech in general. We have been here for more than a decade and we are not giving up on crypto now. While 2022 was a temporary setback, we are much more confident of massive opportunities that lie ahead. We are privileged to be in a position to help projects and founders with our decade plus experience in crypto, along with our global network to help build world class businesses. Winners always come out stronger on the other side. Remember, this is not financial advice and please read Disclaimers at the end of this report.

Leave a Reply